Break Into The $120K+ US Tax Market

EXCLUSIVE OPPORTUNITY – US Tax Season Preparation Batch

US Tax Professional Earning Potential:

Join the elite group of Pakistani professionals serving American businesses remotely!

Every year, millions of American businesses and individuals struggle to navigate complex US tax regulations. Meanwhile, talented accounting professionals in Pakistan remain unaware of the massive remote opportunities in US taxation services.

The Reality Check:

Your Competitive Advantage:

The Numbers Don’t Lie: US tax preparation industry generates over $15 billion annually, with average tax preparers earning $35-85 per return. Working just 14 hours during tax season can generate $25,000+ in additional income.

What’s stopping you?

Simply the knowledge gap in US tax laws, regulations, and compliance procedures – exactly what our comprehensive course eliminates. While this program specializes in U.S. taxation, many professionals also expand their learning with our UAE Taxation to gain a comparative perspective on global tax systems.

Our US Taxation course is specifically designed for Pakistani accounting professionals who want to tap into the lucrative American tax market without relocating.

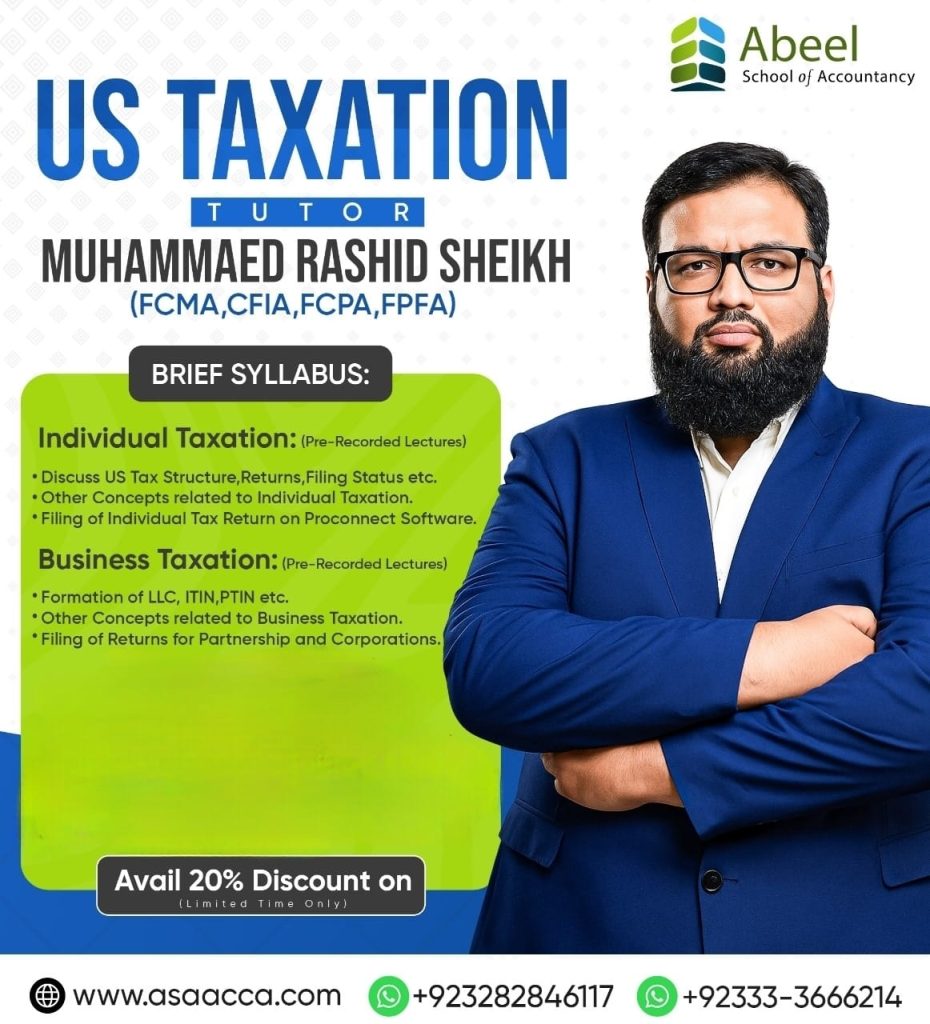

What You’ll Learn:

Individual Taxation

2. Business Taxation

Course Highlights

Federal Taxation Expertise

Master the Internal Revenue Code (IRC) with practical applications:

State Taxation Specialization

Navigate the complexity of 50+ state tax systems:

Practical Tax Software Training

Hands-on experience with industry-standard tools:

US Tax Compliance and Ethics

Professional standards and regulatory knowledge:

Meet Your Expert Instructor

Why is he a Perfect Instructor for Pakistani Students?

Flexible Learning Format

Comprehensive Learning Materials

Real-World Application

Technology Integration

ASAACCA is a trusted bridge to help you land successfully in the american taxation job market because:

Remote Work Opportunities with American Firms

The Remote Revolution in Tax Services:

Freelance US Tax Preparation Business

Build Your Independent Practice:

Corporate Employment Pathways

Target Companies Actively Hiring:

Specialization Tracks for Higher Earnings

High-Value Niche Areas:

Get Enrolled Now!

A: No! 78% of our graduates work remotely from Pakistan with US firms. The course specifically prepares you for remote tax preparation and compliance services.

A: Multiple options: US bank transfers, PayPal, Payoneer, or local Pakistani bank wire transfers. We provide complete guidance on payment processing and tax implications.

A: Entry-level US remote tax positions start at $45,000-65,000 annually (PKR 220,000-320,000 monthly), typically 3-5x higher than equivalent local positions.

A: While tax season (January-April) is peak, year-round opportunities exist in bookkeeping, quarterly filings, tax planning, and business advisory services.

A: For basic tax preparation, no license required. For IRS representation, you can pursue Enrolled Agent status. For CPA services, individual state requirements vary.

A: We provide lifetime access to tax law updates, webinars, and annual refresher courses to keep your knowledge current with IRS changes.

A: Direct introductions to partner firms, resume placement services, interview coaching, and access to exclusive job boards for graduates only.